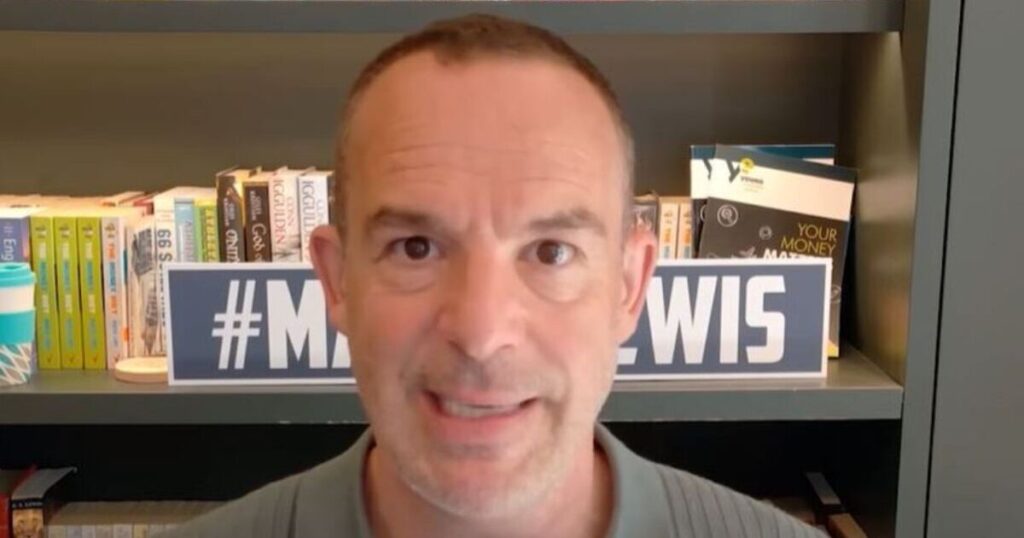

Martin Lewis has told savers to act fast and take advantage of current Cash ISA rules as he says the government is considering changing the rules. The money expert has advised savers to place their money into a Cash ISA as soon as possible amid reports that Rachel Reeves is considering a significant reduction in the allowance given to Brits, something Lewis says he knows to be “fact” rather than rumours.

British savers can currently gain tax-free interest on their savings of up to £20,000 when they place it in a Cash ISA. However, Lewis says that Reeves is considering a reduction of this allowance to as low as £4,000. As a result, he is urging savers to take advantage of the current Cash ISA benefits available to them before any potential changes come into effect.

“The Chancellor, Rachel Reeves, has been evaluating cutting the Cash ISA allowance. That’s not a rumour. I know it for fact. And it’s being talked about in political and policy circles,” Lewis said.

He added: “What we don’t know is if anything has been decided and if it has, what has been decided. Now, the first thing to say [is] I’ve had people get in touch with me panicked about this; [but] it wouldn’t impact any money you already have saved in Cash ISAs.

“They’re talking about lowering the limit of how much money you could put in in future, so there’s no need to panic about your existing Cash ISAs if the rumours are correct. As for when it starts, well, if it is announced in the Autumn Budget, there’s a chance it could start immediately so it would instantly lower your Cash ISA allowance.”

He continued: “Or there’s precedent for ISA changes for them doing the change, announcing it in autumn and starting it in the January or starting it in April 2026 – the new tax year. But for me, what all this means is if you are planning to save into a Cash ISA this tax year and you’ve got the money, getting the money in sooner would seem safer – in case there is a risk of the allowance being cut.

“Now, you might have personal reasons why that doesn’t work, or the specific products you want or interest rates you want, well that doesn’t work. But as a general rule, I would think, right now, sooner is safer.”

Meanwhile, the Bank of England is anticipated to cut rates at the next Monetary Policy Committee meeting, which takes place on May 8, which is expected to trigger a fall in Cash ISA interest rates. Savers are being urged to act before May 1 to make sure they are getting the most out of their money by placing their savings into a fixed-rate Cash ISA before any potential drop in rates.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal